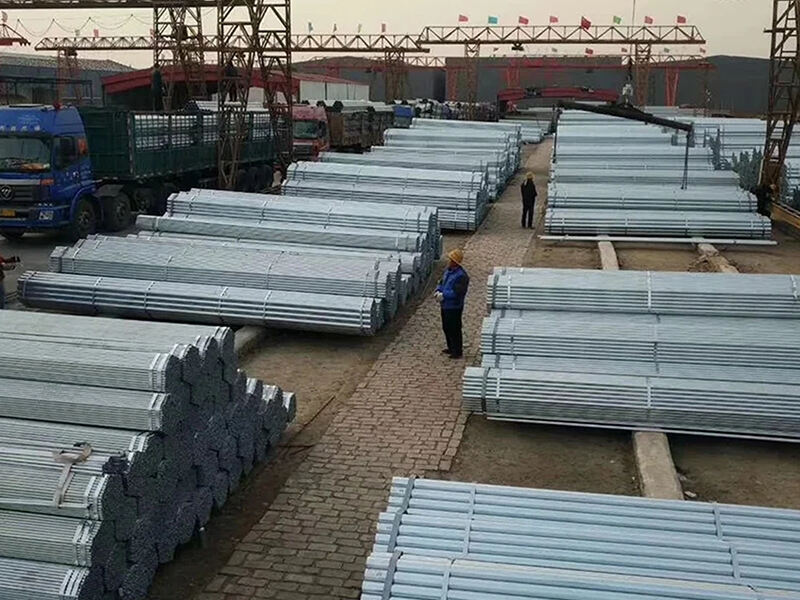

The steel industry in the world market has gone through the most violent time ever in the life of the industry, price curve swings have been swerving enormously due to the pressure of international market forces. We also understand these market forces and have developed strategic measures to enable our partners to navigate these adverse situations.

The Perfect Storm: Factors Reshaping Steel Pricing

Several powerful forces are converging to create today's complex pricing landscape:

Trade policy makeshing: U.S. holding on to Section 232 tariffs and the EU taking steps on carbon border adjustment

Supply chain reconfiguration: Regionalization trend in developing new trade corridors

Raw material volatility: A 20-30 percent quarterly variability in the prices of iron ore and zinc

Energy market impacts: Natural gas price fluctuations affecting production costs

Breaking Through the Price Ceiling: Four Strategic Approaches

Product Specialization Strategy

Focusing on high-value products like:

Medical equipment stainless steel (ultra-thin precision)

EV battery cases made of high-strength galvanized steel

Custom alloy formulations for specialized industrial applications

Supply Chain Innovation

To avoid trade barriers, they establish regional processing centers.

The advancement of conventional hybrid procurement common to spot and contract purchases

Applying the usage of strategic buffer stocks and the just-in-time inventory systems

Cost optimization with the aid of technology

High-levels of production control averting wastage by 12-15%.

Logistics routing reduction of transportation expenses by AI support

Predictive maintenance that will reduce unplanned outages

Green Premium Positioning

Creating low-carbon products lines with confirmed emissions statistics

The use of the circular economy models with recycled content

Gaining sustainability certification to receive higher prices

Our Value Proposition in Volatile Markets

Shandong Runhai offers clients:

Flexible contract terms of price stability programs

Technical advisory on the alternatives of material substitution services

Our international sources of supply that offers dual-source coverability.

Market intelligence is used to report on buying decisions

Looking Ahead: The New Normal in Steel Trading

The industry is moving toward:

More regionalized but interconnected supply webs

Digital trading platforms with transparent pricing

Cost structures that are carbon-adjusted

Management of inventories in teams

Conclusion

Even though market volatility is an issue that needs addressing, it opens the space for quick and swift suppliers and savvy customers. Working on specialization, supply chain innovation, and value-added services we will be able to break through constraints of price curve together.

Speak with one of our trade experts today to find out more on bespoke solutions to meet your unique market challenges.

EN

EN

AR

AR

BG

BG

FR

FR

DE

DE

HI

HI

IT

IT

JA

JA

KO

KO

PT

PT

RO

RO

RU

RU

ES

ES

TL

TL

IW

IW

ID

ID

LV

LV

LT

LT

SR

SR

SK

SK

SL

SL

UK

UK

VI

VI

SQ

SQ

GL

GL

HU

HU

MT

MT

TH

TH

TR

TR

AF

AF

GA

GA

BE

BE

MK

MK

HY

HY

AZ

AZ

KA

KA

BN

BN

BS

BS

LO

LO

MN

MN